How Fintech Application Development Will Transform Finance Industry?

THE INNOVATION OF THE FINANCE AND TECHNOLOGY CHANGES AS PER OUR BUSINESS AND WILLINGNESS TO PROGRESS.

Fintech or Financial technology has become a popular industry and helping to innovate financial transaction services and online security.

It is a broad term that works around the business transformation to innovate the traditional financial services that are inefficient, antiquated, and expensive. This has made the process transparent and straightforward.

In this article, we are going to understand how the Fintech Application Development will positively transform the financial industry. But before that, let’s understand more about the Fintech Application Development.

The Emergence of Fintech Application Development –

Fintech technology has transformed and innovated financial services through the new technologies that have fulfilled the customer’s needs with the help of automation.

This is due to the factors including consolidation in the financial services industry and regulatory constraints.

It is all about innovation that has helped a lot in upgrading the financial industry. The Fintech startups have the benefit of working independently, and that’s why they can develop faster than the companies following the traditional methods of providing financial services.

To acquire the customers, the financial services firms have to choose between the building of their capabilities and seeking out for a Fintech partner to get help in innovation initiatives.

This has helped the Fintech firms to provide new applications, both directly and indirectly. In this case, most of the firms are going for a hybrid approach.

A non-profit innovation center, Fintech Sandbox, was established by Jean Donnelley in March 2015.

The mission behind this company was to bring the latest technologies in the market and transform the meaning of financial services.

Today, it has helped a lot in the development of products and service solutions that have the potential to innovate their financial services.

Also Read – How Blockchain Technology is helping Mobile App Developers?

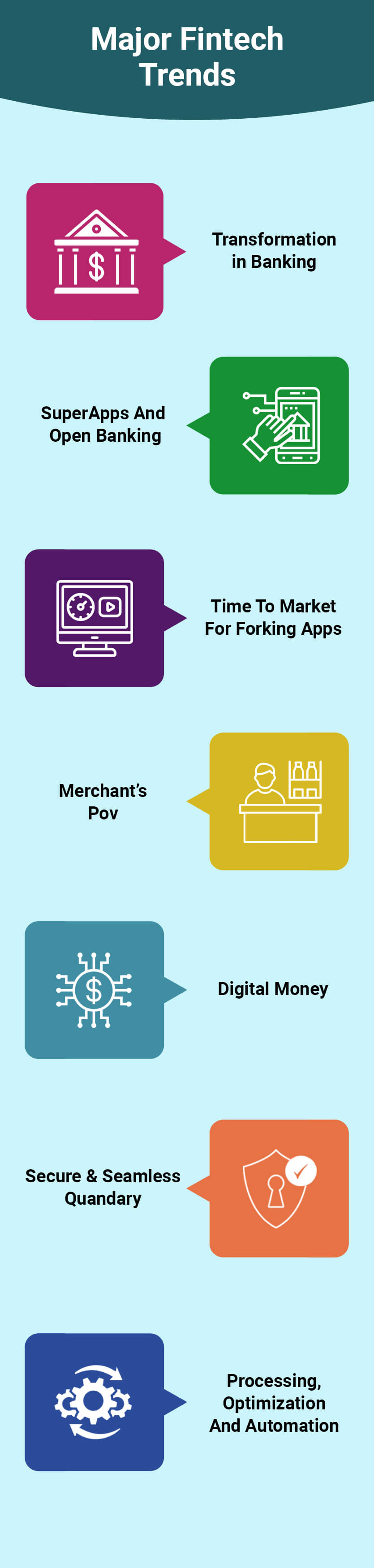

Fintech Trends That Will Help in Upgrading the Financial Industry –

1. Major Transformation in Banking and Incumbent Payment Providers –

There has been a vast evaluation in the online payment methods, and the reason behind it is the emergence of Fintech Trend. It is making a great impact on the financial industry.

In the current scenario, the online payment providers and backs are changing their working system dynamically.

Even due to Digitalization or digital transformation, much international business model has transformed the financial companies and will do the same in the future.

The boundaries between disconnected industry sectors are also disappearing due to the noticeable Fintech advancement.

It has opened up the doors for incumbents and Fintech companies. The new market players in the market are stealing the customers of the old market as they work on the innovation.

Nowadays, people focus on financial services as it has made everything easier for them. The global Fintech adoption rate is forecasted to reach 52%, and it is also proved that by 2025, most of the world population will use Fintech services.

It is because of Next-generation payment methods that bypass banks and credit card industries are adopting.

That’s why it is said that Fintech companies should aim to offer innovative services to traditional banks.

2. SuperApps are controlled by PSD2 and Open Banking –

Banking is not just about financial services; it is about artificial intelligence, machine learning, the latest digital technologies, and the ability to leverage the power of customer insights.

It helps the customers to get proper facilities in this tech-savvy world. But how the baking can influence the latest regulations like PSD2? By providing the customer’s database to third-party service providers in a protected way.

The organizations from different industries like banking, media, and other tech-oriented companies compete for this data.

However, the customer’s data for secure payments are lifted by Fintech Companies. Their role has been well-established in the Market.

When we talk about Super Apps, these are not something new. There are many Peer-to-peer lending and investing platforms that are providing financial services to different businesses through the latest technologies.

They all have some sophisticated platforms, but they offer their customers the services through aggregated super apps. It helps their customers to get higher returns on their investments.

Even there are no hidden fees and charges in these methods. This is how the Fintech companies have won the market share and earn competitive advantages over traditional banking methods.

3. The Digital Transformation in Fintech has helped in enabling Time-to-Market for Forking Applications –

There has been tremendous growth in the Cashless payment. Both Banks and PSPs are looking for the opportunity to release the best product-market so that they can fit in the Fintech applications.

Ever the past players, who were part of the Fintech Digital Transformation Programs, are now able to move ahead. They can dive into new financial solutions.

The new applications for Software build have made all the processes, including software infrastructure, testing, development process, source code, elasticity, and self-healing easy.

Most of the Fintech solution providers focus on streamlining software engineer’s work. Because of the API’s and Software libraries, the Software experts can serve their clients with the best user experience.

This has helped the industry to provide standard services, out-of-the-box automation, framework, security capabilities, and monitoring.

Even with a lot of facilities, one can’t be able to enhance their business without pure technology pillars. It helps the users to reduce the fraud risks.

4. Merchant’s POV Is a Centerpiece and the Future of Payment Solutions –

As everyone has the reachability to the next-gen Fintech Solutions, they can use the online payment solutions whenever they want to. It helped the merchants to control their sale point and accept the payments through the internet or mobile devices.

When people use to visit the store and pay from cash, they tend to become bound. But today, everyone gets a chance to pay from anywhere.

It is a chance to build a better relationship between customers, merchants, and payment intermediaries. It’s just; all the merchants should understand the advantages of the next-gen point of the sale and apply it in their services.

When we talk about card growth, it has become a way to bridge the gap of universal acceptance. Even while selecting the online PSP, the merchants choose security as their priority. They are also focusing on Automation as it will make their work easy.

The best part is that customers are already aware of the in-app payments. This allows them to purchase anything and get it delivered at their doorstep. This proves that everyone gets a chance of personalization.

5. The Future of Digital Money –

It’s been years since we can see the noticeable growth in the digital economy, where mobile devices have enabled an explosion in non-traditional financial services. This is where Fintech companies can thrive.

New online payment methods are developing a relationship between individuals and technology. The internet of things has taken off at a very fast pace. As there are most of the machine-to-machine transactions, most of the people call it a digital-only world.

The Physical money concept is diminishing by time. Now, most of the transactions are invisible i.e., done through the internet.

There is no need to withdraw your money and pay it to the merchants. Digital-money has become an important part of our life.

The best part is that most of the online applications are giving a chance to the customers to book a table at restaurants, flight, movie tickets, and hotel rooms or simply buy other stuff online.

There is no involvement of real money, which proves that physical money exchange is getting replaced with the mobile wallets.

6. Secure and Seamless Quandary –

The level of fraudsters continues to adapt. Although there are so many fraud prevention tools present in the market, it is still getting complicated and costly to protect customers and merchants from it.

The main reason behind it is the lack of seamless integration between the merchants and card issues.

Even the chargeback processes get broken from time to time because they are never designed to share actionable intelligence. That’s the reason why it’s hard to avoid the losses of the card issuers and merchants.

Most of the Cardholders and Merchants complaint that the current chargeback process is quite confusing, stressful, and costly. Moreover, it’s not just about cost; the direct expense is complimented with the chargebacks.

This slows down sales and increased customer resistance. Many potential customers will get turned away because of the high cost of fraud recovering.

Both Frauds and Chargebacks are costly and can damage the reputation of a business. However, there are so many security technologies and fingerprint recognition options that have been introduced in the market.

In this innovation, machine learning and advanced data analytics play a significant role. It helps in identifying the shopper and merchant behind every transaction and reduce the chance of fraud.

7. Processing, Optimization, and Automation –

A few years ago, it was hard to imagine the growing rate of financial services companies. At that time, customers use to involve just one or two organizations. But now, Fintech companies are ruling the industry.

They provide the best services of the backs to their customers and helps in the market growth. This is the reason why most of the customers deal with several financial service providers.

If we talk about Fintech growth, it took place after the 2008 financial crisis. At that time, most of the banks pulled back on almost every activity in order to reduce the risk rate.

This allowed the Fintech companies to involve with the back and build a whole new market place.

The banks and Fintech Companies and banks are focusing on these points, and that’s why they have introduced the robotic process automation.

It is one of the impactful trends of Fintech. It is speedy, cost-saving, scalable, integrated, and offers high-quality services. This has changed the whole working system.

What Can You Learn from Fintech Companies?

Traditional banks can adopt Fintech Practices in three ways. It will help them to differentiate their brand and lead from their competitors in this rapidly upgrading business environment.

1. Move Beyond Your Comfort Zone –

For the growth, the companies have to come out of their comfort zone. Fintech Companies has proved that size is no longer protection from a savvy startup.

The place where the technology is influencing the customer’s needs is the area where you get endless opportunities.

Here, the chances to predict the future is much less. Traditional banks have to follow the innovation and entrepreneurial methods of Fintechs into their business; otherwise, they will simply fall behind.

2. Follow a Customer-Centric Approach –

One of the biggest differentiators between Fintechs and traditional banks is that Fintech companies work on the customer-first approach. It helps them to handle everything digitally and design and deliver the products accordingly.

All digital-savvy customers are looking for convenience, ease, and understandable online banking.

To deliver the customers with the same, a company should know what their customers want. Machine-based learning and other technologies have helped in gaining insights.

3. Leverage Your Data –

Fintech Companies were the startups that have the speed and nimbleness to lead the innovation where traditional banks are still struggling. But most of the banks offer a fair share of advantages when it comes to data.

Most of the well-established companies can store huge data with time. They should use the same data to understand their customer’s requirements.

However, most of the developed brand is following machine-based learning and AI to help their customers to fulfill their needs.

Also, they are providing more time for their employees to pay attention to complex solutions.

Conclusion –

Fintech will transform the Financial Industry by working on the following concepts: the real-time payment methods, artificial intelligence, industry 4.0, latest technologies, deeper and better data capture, Blockchain, Collaborating into one and Robo-advisors.

Fintech has the potential to transform the business’s nature with technologies and the following trends, including building a better relationship between merchants and customers and anything that will solve the problem of financial inclusion.

Author Bio –

Harikrishna Kundariya, a marketer, developer, IoT, ChatBot & Blockchain savvy, designer, co-founder, Director of eSparkBiz Technologies, a Mobile App Development Company. His 8+ experience enables him to provide digital solutions to new start-ups based on IoT and ChatBot.

Also Read – How Face Recognition Technology is shaping the future of various industries?